Finding new ways to save money is key in today’s economy. Have you thought about how much you could save by changing how you spend? There are many ways to cut costs, from managing subscriptions to planning meals.

The average American family spends $219 a month on subscriptions without knowing it. Food waste costs the country almost $473 billion a year. With costs going up in insurance, transport, and fun, being frugal can really help your finances.

Imagine finding secret savings and changing how you handle money. This guide will show you many creative and useful ways to save money. It will help you deal with the financial world of 2025 and beyond.

Table of Contents

Smart Subscription Management for Maximum Savings

Americans spend about $219 a month on subscriptions. This is often $133 more than they think. To cut costs, try subscription hopping, family plan optimization, and ad-supported services.

Subscription Hopping Strategies

Switching between streaming services can save you money. Sharing subscriptions with friends and family can cut costs by about $50 per person monthly. Some services offer great value if you watch ads.

Family Plan Optimization

Many services have family plans for sharing costs with loved ones. Mint, a top money app, and Twine, for couples, help track shared expenses and goals.

Ad-Supported Alternatives

Choose ad-supported options for big savings. For example, Earnin lets you access up to $500 of your paycheck early. Plus, saving $10 with “Tip Yourself” could win you prizes.

Using these budgeting tips can greatly lower your subscription expenses. It also boosts your smart spending habits.

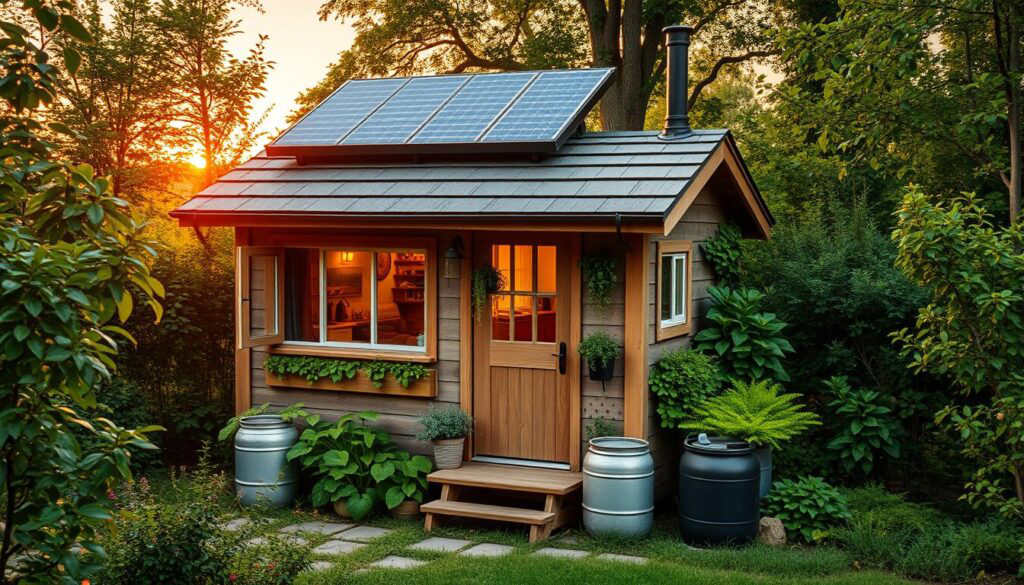

Innovative Housing Cost Reduction Techniques

In the quest for cost-effective living, new housing ideas are coming up. They aim to cut down on building and living costs. For example, a TV writer in Los Angeles shares a big house with three others. They turned the garage into a shared office. This move cuts down on rent and boosts networking.

Groups like Ivory Innovations are pushing for more frugal living options. Their Ivory Prize for Housing Affordability has over 200 entries. These ideas include new financing, design, and policy changes to make homes more affordable.

The housing world is changing fast with 3D-printed homes and green building materials. Companies like BotBuilt, Diamond Age, and Inherenthomes are at the forefront. They offer ways to lower building costs, energy use, and upkeep for homeowners.

Technology, using old spaces, and new building ways are changing the housing scene. They offer frugal living choices for today’s buyers and renters. These new ideas promise to make owning a home more possible and lasting for everyone.

Strategic Meal Planning and Grocery Shopping

Savvy saving begins in the kitchen. Planning meals and shopping smart can cut down grocery costs and reduce waste. A good start is weekly meal planning. Take a few minutes each week to check what you have, then make a shopping list and plan meals. This way, you avoid buying things on impulse and only get what you need.

Bulk Cooking Methods

Bulk cooking, like using an Instant Pot for meal prep, can save money. Cook big batches of your favorite dishes and freeze them for later. This saves time and money by using ingredients efficiently.

Smart Shopping Tactics

Smart shopping at the grocery store involves a few key strategies. Don’t shop when you’re hungry to avoid buying things you don’t need. Stick to your list and look for store-brand items, which are often cheaper but just as good. Also, use sales and coupons, and buy in bulk when it’s a good deal.

Food Waste Prevention

To avoid wasting food, freeze leftovers and get creative with them. Americans throw away about 92 billion pounds of food each year, which is a lot of money and food. By using leftovers and finding new ways to use ingredients, you save money and help the planet.

By using these cost-cutting strategies and smart spending tips, you can reach your savvy saving goals. This is true whether you’re cooking for a family or just for yourself.

Creative Ways to Save Money on Transportation

Transportation costs can be a big challenge in your budget. But, with smart planning, you can find ways to save. For example, buying a hybrid vehicle can save you up to $300 a month on gas, especially in places like Los Angeles. Plus, hybrids let you use carpool lanes, saving you time in traffic.

Looking at other ways to save is also smart. Try carpooling with coworkers, using public transit, or biking for short trips. These options can lower your transportation costs. Using public transit not only saves money but also helps the environment.

- Explore the benefits of hybrid vehicles to maximize fuel efficiency and access carpool lanes.

- Consider carpooling, public transportation, or biking for short distances to cut down on transportation costs.

- Seek out employer-sponsored transit benefits or discounted public transit passes to reduce your out-of-pocket expenses.

By using a combination of these cost-cutting strategies, you can greatly reduce your transportation costs. This way, you can spend wisely on your daily commute and travel needs.

Entertainment and Media Cost Cutting

In today’s digital age, entertainment and media can add up fast. But, with smart strategies, you can enjoy life without spending a lot. Use libraries and free entertainment to live frugally.

Library Resource Maximization

Your local library is full of free fun. You can borrow books, audiobooks, movies, and TV shows for free. Use apps like Hoopla and Overdrive for digital content. Also, check out library events like author talks and movie nights.

Digital Content Sharing

Sharing digital content is a great way to save money. Savvy saving comes from sharing Kindle books with others. Join review sites like NetGalley for free books and audiobooks before they’re released. These tips help you enjoy media without spending a lot.

Free Entertainment Options

- Look for free events in your community, like concerts and festivals.

- Visit national and state parks for affordable fun. They often have free days.

- Host game or movie nights at home with friends and family. It’s cheaper than going out.

- Use websites like Groupon and LivingSocial for discounts on entertainment.

By using these frugal living tips, you can enjoy entertainment and media without spending a lot. Enjoy your life while keeping your wallet happy.

Energy-Efficient Home Improvements

With utility costs going up, saving money at home is key. One smart way is to make your home more energy-efficient. This can cut down your monthly bills a lot.

The EPA says good insulation can save up to 15% on heating and cooling. Smart thermostats help save energy when you’re not home or sleeping. Sealing drafts and updating old windows also boosts energy efficiency.

Installing leak detectors in pipes is another smart move. It stops water waste and keeps your bills steady. By making your home more energy-efficient, you save money and help the planet.

Experts say the number of smart homes will keep growing. By 2027, over 670 million units are expected. People want smart homes to save money and use less energy.

Adding energy-efficient upgrades can lower your bills and help the environment. Start making your home more energy-efficient today. It’s a step towards saving money and being eco-friendly.

Modern Money-Saving Technology Hacks

In today’s digital world, using technology can really help you reach your financial goals. You can optimize your devices, use apps to save, and find digital coupons. These methods can make saving and spending smarter.

Smart Device Optimization

Look at your tech devices closely. Instead of buying new gadgets all the time, think about keeping what you have for a bit longer. A TV writer in Los Angeles, for example, has been using a three-year-old phone and a five-year-old laptop. This saved him thousands and kept him productive.

App-Based Savings Tools

- Check out easy-to-use apps for budgeting and tracking expenses. They can help you manage your money better and give you tips to save more.

- Use apps that give you cash back or other rewards for your daily spending.

- Find tools that combine all your loyalty and rewards programs. This way, you get the most from your loyalty.

Digital Coupon Strategies

Use digital coupon sites and browser extensions to get discounts automatically at checkout. This can save you money on lots of things. Also, sign up for newsletters or follow your favorite brands on social media. This way, you’ll know about sales and special offers.

By using these modern tech hacks, you can find many ways to save money and improve your financial health.

Collaborative Purchasing Power

In the quest for cost-effective living, smart shoppers are teaming up. They join forces with friends, family, or coworkers to save big on many items. This smart spending strategy lets you enjoy the perks of group buying and savvy saving.

For example, a group of coworkers bought a top-notch coffee maker for their office. Each paid $20 a month. They got a great coffee maker that would have been too pricey alone. It also cut down on daily café trips.

There are many chances to buy together, from big items like electronics to everyday needs. Group buying lets you get discounts and deals you can’t get alone. It saves money and builds a sense of community.

To get the most out of buying together, plan to go shopping with your friends. Look for things you all need, then shop around and talk to sellers for the best deals. The more you work together, the more you can save.

Using group buying is a smart move for cost-effective living. It helps you save, improves your life, and promotes savvy saving in your community.

Insurance Cost Optimization Techniques

Managing your expenses wisely can greatly improve your financial health. Americans spend a lot on auto and homeowners insurance each year. By using smart strategies, you can cut these costs by 5-25% annually.

Policy Bundling Benefits

Bundling your insurance policies can save you money. Many providers give discounts of up to 25% for bundling auto and home insurance. This makes paying easier and keeps your coverage organized.

Coverage Customization Options

Reviewing and updating your insurance coverage can save you a lot. Ensure your policies offer the right protection without being too expensive. Adjusting deductibles or removing coverage on older vehicles can help cut costs.

Discount Qualification Strategies

Getting discounts is a smart way to lower your insurance costs. There are many discounts available, like for safe driving, good credit, and home security systems. Using these can lead to big savings on your premiums.

By using these expense reduction methods, you can spend smarter and keep your financial wellness strong.

Side Hustle Opportunities for Extra Income

Adding side gigs to your income can be a smart move. It helps boost your financial health and reach your savings goals. Whether you’re a TV writer in LA or a busy professional, there are many ways to earn extra cash on your own time.

Freelance work is a lucrative option. You can use platforms like Upwork and Fiverr to show off your skills. This includes writing, graphic design, or web development. Online tutoring is also popular, where you teach math, science, or language arts to students of all ages.

If you’re good at crafting or making handmade items, try selling them on Etsy. It’s a great way to make money from your hobbies. The gig economy also offers flexible jobs. You can earn extra by delivering groceries, walking dogs, or pet-sitting through services like Shipt, Wag, and Rover.

Success in side hustling comes from finding the right fit for your skills, interests, and schedule. By exploring these creative ways to save money and earn extra, you can improve your financial wellness and meet your smart spending goals.

- Freelance writing, graphic design, or web development

- Online tutoring in various subjects

- Selling handmade crafts or products on e-commerce platforms

- Gig work such as grocery delivery, pet-sitting, or ridesharing

Smart Banking and Investment Strategies

To improve your financial health, you need smart banking and investing. Look into high-yield savings accounts and use automated savings. Also, consider smart investment platforms to grow your money and reach your goals.

High-Yield Account Benefits

Today, traditional savings accounts don’t earn much due to low interest rates. Check out high-yield savings accounts for better returns. They help your savings grow faster, giving you a higher return on your money.

Automated Savings Methods

- Automate transfers from your checking to a savings account. This “pay yourself first” method helps build savings without manual effort.

- Try micro-savings apps that round up your purchases. They add small amounts to your savings, growing it over time.

Investment Platform Options

For long-term growth, look into low-cost investment platforms. They offer a variety, from robo-advisors to DIY trading accounts. These platforms have lower fees than traditional advisors, helping you keep more of your investment gains.

Smart banking and investing are crucial for financial wellness. By optimizing your savings and investments, you can maximize your money’s potential. This way, you take charge of your financial future.

Minimalist Living Approaches

Embracing minimalist principles can help you live frugally and reduce expenses. Decluttering and avoiding unnecessary buys are crucial steps. By valuing experiences over stuff, you save money and live more intentionally.

Not buying the latest tech can save you a lot of money. Instead of always getting new gadgets, use what you have until it’s really outdated. This minimalist way of thinking helps you focus on what’s truly important and cuts down on waste.

Minimalism isn’t just about spending less. You can still make big purchases if they match your values and add meaning to your life. The goal is to find a balance between being minimalist and saving money so you’re happy and fulfilled.