Are you a homeowner worried about the rising cost of home insurance? You’re not alone. Rates have gone up 19.8% from 2021 to 2023. The average annual rate now is $2,377, up from $1,984.

Insurify predicts a 6% increase in 2024. This will make the national average $2,522 by the end of the year. It’s a big jump.

Florida homeowners face the highest rates, with an average of $10,996 in 2023. For 2024, rates are expected to rise by 7% to $11,759. With a predicted severe hurricane season, rates might go even higher in 2025.

Table of Contents

Understanding Home Insurance Rate Trends in 2025

Homeowners insurance costs in the U.S. have gone up a lot over 20 years. The average yearly premium went from $536 in 2001 to $1,411 in 2021. This trend is likely to keep going up because of climate change and other factors.

Historical Rate Changes from 2021-2024

The cost of homeowners insurance went from $729 in 2004 to $909 in 2010. It hit $1,030 in 2012 and $1,410 by 2021. This big jump was mainly because of more frequent and severe natural disasters like wildfires and hurricanes.

Projected Rate Increases for 2025

Experts say homeowners can expect even higher rates in the future. Insurify predicts a 6% increase in 2024, making the average $2,522. This trend is expected to keep going as the industry deals with changing risks.

Impact of Climate Change on Insurance Costs

Climate change is expected to have a big impact on home insurance rates. Weather Bell predicts a “hurricane season from hell” in 2024, with 6-8 major hurricanes. This will likely make insurance more expensive for homeowners in those areas.

Rising home values, higher construction costs, and more climate-related disasters will keep pushing up insurance rates. Homeowners will need to look closely at their coverage and work with insurers to get the best deal in 2025 and later.

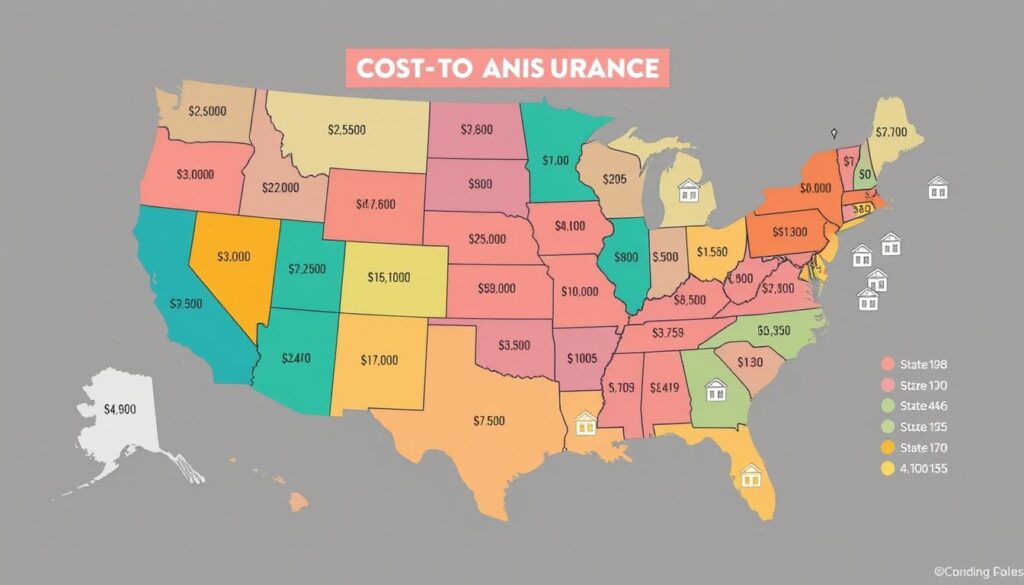

Home Insurance Rates Comparison: State-by-State Analysis

When looking for affordable home coverage options and home protection plans, knowing the rate differences is key. Rates vary greatly from Vermont’s scenic views to Florida’s hurricane risks. This shows how location affects home insurance costs.

Vermont has the lowest average annual rate at $918. Florida, however, has the highest at $10,996. This big difference shows how location impacts home insurance costs.

Places like Florida, Louisiana, and Texas face high costs due to hurricane risks. Nebraska, Texas, and Kansas deal with tornado risks. Colorado and Nebraska face growing wildfire threats, leading to higher home insurance rates.

| Most Expensive States for Home Insurance | Least Expensive States for Home Insurance |

|---|---|

|

|

Understanding home insurance rates is crucial. Look for affordable options and home protection plans that fit your budget. This ensures you get the best coverage at a price you can afford.

Top 10 Most Expensive States for Home Insurance

Homeowners in the U.S. are facing higher insurance costs. Some states are especially hard to find competitive home insurance pricing. The top 10 most expensive states for home insurance in 2023 and their average annual costs were:

- Florida: $10,996

- Louisiana: $6,354

- Oklahoma: $5,444

- Texas: $4,456

- Mississippi: $4,312

- Colorado: $4,072

- Nebraska: $3,962

- Alabama: $3,939

- Kansas: $3,437

- Arkansas: $3,368

Florida’s Premium Crisis

Florida has the highest home insurance rates. The average annual premium is expected to hit $11,759 in 2024. This is a big jump from $10,996 in 2023. Hurricanes are the main reason for these high costs.

Louisiana’s Rising Rates

Louisiana is also seeing a big increase in home insurance costs. The average annual premium is expected to rise from $6,354 in 2023 to $7,809 in 2024. This is a 23% jump. Hurricanes and other severe weather events are to blame.

Oklahoma’s Weather-Related Increases

Oklahoma is third on the list with rising home insurance premiums. The average annual cost is expected to go from $5,444 in 2023 to $5,711 in 2024. This increase is due to severe weather like tornadoes and hail storms.

Homeowners in these top 10 states need to use the house insurance premiums calculator carefully. They must think about climate change, regional risks, and how insurance companies handle these issues.

Factors Driving Insurance Rate Increases

Understanding the rise in home insurance rates is key in 2025. Severe weather events, caused by climate change, are the main reason. Texas, Florida, and Louisiana have seen damages worth hundreds of billions of dollars. This has put a lot of pressure on the insurance industry.

Natural disasters like hurricanes, wildfires, and floods are happening more often and getting worse. This means claims are costing more, leading to higher premiums. Also, the cost of building materials and labor is going up. This makes fixing and rebuilding homes more expensive.

Inflation is another big factor in rising home insurance costs. As living costs go up, insurers need to raise their rates. This mix of environmental, economic, and logistical factors has led to higher insurance rates in many parts of the U.S.

| Cost Factor | Impact on Home Insurance Rates |

|---|---|

| Severe Weather Events | Increased frequency and intensity of natural disasters, leading to higher claims and premium adjustments |

| Rising Repair Costs | Escalating prices for building materials and labor, making it more expensive to repair and rebuild damaged homes |

| Inflation | Overall increase in the cost of living, putting pressure on insurers to raise rates to keep up with economic conditions |

Homeowners are facing higher insurance costs and need to stay informed. We’ll look at how rates vary by region and ways to find affordable coverage.

Climate Change Impact on Regional Insurance Costs

Homeowners across the United States are facing big challenges with home insurance due to climate change. Natural disasters like hurricanes, wildfires, and floods are becoming more common and severe. This is causing insurance costs to rise and forcing insurers to rethink their pricing and coverage.

Hurricane-Prone Areas

In states like Florida and Louisiana, hurricanes are a big problem. Home insurance costs have skyrocketed. For example, in Enid, Oklahoma, the average home insurance cost was about $2,113 in 2023. This is more than six times the national average.

In McCurtain County, Oklahoma, homeowners paid an average of $2,837 for insurance. Meanwhile, in Little River County, Arkansas, the average was $1,673. These numbers show how insurance costs vary by region.

Wildfire Risk Zones

The western United States, including Utah, Montana, and Nevada, is facing a growing wildfire threat. This is causing home insurance costs to go up. Insurers are raising premiums to try to manage their risk better.

Flood-Susceptible Regions

Coastal states like Maine are dealing with rising sea levels and more coastal storms. By 2050, sea levels are expected to rise by 1.5 feet. This could make coastal storms much worse.

This increased flood risk is making home insurance more expensive in these areas.

The impact of climate change on home insurance costs is clear. It’s time for everyone to come together to find solutions. Policymakers, insurers, and homeowners need to work together. They should aim to make home insurance more affordable and accessible. They should also focus on making homes and communities more resilient to climate change.

Understanding Coverage Options and Policy Types

As a homeowner, understanding home insurance can be tough. But knowing the different home insurance policy types and homeowners coverage options is key. This ensures your property and belongings are well-protected. Let’s look at the various policy types and coverage options available.

The HO-3 policy is the most common. It offers “all risks” coverage for your home and named-peril coverage for your personal items. This means your home is protected against many dangers. Your personal items are covered for specific events like fire, theft, or vandalism.

If you want more coverage, the HO-5 policy is the most comprehensive. It provides open-peril protection for both your home and personal items. This policy is often suggested for homes and items of high value.

- HO-1 policies are named-peril policies, covering only specific loss events.

- HO-2 policies cover a wider range of named perils, including water damage, falling objects, and freezing of pipes.

- HO-4 policies, also known as renters insurance, protect personal belongings and provide liability coverage for renters.

- HO-6 policies are designed for condominium owners, covering the individual unit and personal liability.

- HO-7 policies are tailored for mobile or manufactured homes, providing coverage for the structure, personal belongings, and more.

- HO-8 policies are suitable for older homes, with coverage adapted to the unique characteristics of these properties.

It’s crucial to review your coverage options every year. This ensures your home and belongings are well-protected. This is especially important as inflation and market conditions change.

Strategies for Finding Affordable Home Insurance

Finding affordable home insurance takes effort and a proactive mindset. The first step is to compare quotes from top insurers. This way, you can find the best deal that fits your needs. Many insurers offer discounts and savings that can lower your costs a lot.

Comparing Multiple Quotes

In states with high home insurance costs, like Florida, it’s even more important to shop around. This is because the market changes fast. By comparing quotes, you can find the right carrier and coverage for your situation.

Available Discounts and Savings

- Insurers give discounts for home security systems, fire alarms, and sprinkler systems.

- Keeping a clean claims record for three years can save you a lot.

- Getting your home and auto insurance from the same provider can save up to 24% in states like Texas.

Bundling Options

Getting your home and auto insurance together can lower your costs. But, make sure to compare the bundled rates with single policies. Insurers like State Farm and Nationwide offer great discounts in Texas.

By using these strategies, you can save a lot on your homeowner’s coverage. And you’ll have peace of mind knowing your home is well-protected.

State Insurance Regulations and Consumer Protections

State regulations and consumer protection laws are key in the insurance world. For example, Florida has passed Senate Bill 7052. This bill helps protect homeowners from unfair legal practices and misuse of assignment of benefits (AOB).

Knowing about state insurance rules helps homeowners make better choices. The National Association of Insurance Commissioners (NAIC) works to keep markets fair and protect consumers.

| State | Key Regulations | Consumer Protections |

|---|---|---|

| Florida | Senate Bill 7052 – Combats legal system abuse and AOB misuse | Increased consumer protections against insurance-related issues |

| California | Proposition 103 – Requires public review of insurance rates | Savings of $884.8 million for policyholders through rate hike challenges |

| Georgia | Amica and Auto-Owners as top-rated home insurance providers | Offer discounts and fewer consumer complaints compared to industry average |

Homeowners insurance covers many things, like damage to the house and personal property. It also covers liability and extra living expenses. Knowing about different types of coverage, like the Special Form policy, helps consumers choose wisely.

By keeping up with state insurance rules and consumer laws, homeowners can find the best insurance deals. This ensures they get good coverage without spending too much.

The Role of Credit Scores in Insurance Rates

Your credit score can greatly affect your home insurance costs. Insurance companies use credit scores to set your rates. Those with better credit scores often pay less because they’re less likely to file claims.

But, the use of credit scores in insurance is a big debate. Some states like California, Maryland, and Massachusetts limit how much credit scores can influence rates. In these places, insurers must look at other factors for setting premiums.

In most of the country, though, credit scores are key in determining your rates. Those with poor credit might pay up to 73% more than those with good credit. For example, the average annual premium for good credit is $1,915, while for poor credit, it’s $3,320.

Good credit for insurance is usually between 690 and 719. Scores below 630 are considered poor. Boosting your credit can save you a lot on insurance, as insurers see lower scores as a risk of more claims.

Improving your credit score can help lower your insurance rates. Paying bills on time, reducing debt, and keeping a long credit history are all good steps. By understanding how credit affects insurance and improving your finances, you can save on your home coverage.

Impact of Home Location on Insurance Costs

Your home’s location greatly affects your homeowners insurance rates. Rates can change a lot based on where you live. This includes whether you live in a city or a rural area and if you’re close to the coast.

Urban vs. Rural Rates

People living in cities often pay more for insurance. This is because cities have more crime and rebuilding costs are higher. On the other hand, homes in rural areas might cost less. But, they might pay more if they’re far from fire services.

Coastal Property Considerations

Coastal homes usually have the highest insurance costs. This is because they face risks from hurricanes and flooding. For example, South Florida has six of the top 10 cities for expensive home insurance.

To get a good deal, compare location-based insurance rates for urban vs. rural home insurance. Also, think about the risks of living by the coast. Knowing how your location affects insurance costs helps you protect your home and money.

Insurance Company Financial Stability Ratings

Choosing the right home insurance is key, especially in risky areas. In Florida, many insurers have gone bankrupt since 2019. This leaves homeowners in a tough spot. Big insurers have stopped covering high-risk homes, making things even harder.

It’s vital to check an insurer’s financial stability rating before picking a policy. This ensures they can pay claims if disaster strikes. In Florida, the average home insurance cost is $5,527 a year for $300,000 coverage. This is 140% more than the national average, showing why picking a solid insurance company is crucial.

Bankrate’s team looked at rates, coverage, discounts, and more to help you choose. They found Chubb and State Farm to be top Florida home insurance companies for 2024.

NerdWallet studied over 30 insurers in Florida. They found the best ones had 4.5 stars or more. Rates varied, with some companies offering $2,480 and $2,800 a year.

| Insurance Company | Financial Stability Rating | Average Annual Rate |

|---|---|---|

| Chubb | 5.0 stars | $2,800 |

| Amica | 5.0 stars | $2,480 |

| Auto Club Group (AAA) | 4.5 stars | $2,620 |

When picking a home insurance provider, look at their financial stability and expert ratings. This ensures your home and assets are safe, even from natural disasters or unexpected events.

Future Trends in Home Insurance Markets

The home insurance market is changing fast. This is thanks to new technology and coverage options. Insurers are finding new ways to assess risks and offer policies that fit each homeowner’s needs.

Technology Impact on Pricing

Smart home devices and AI are changing how insurers look at risks. They use data from these devices to understand a home’s condition and how it’s used. This helps them offer insurance market trends that are more accurate and tailored to each homeowner.

This tech integration means prices will better match the risks a home faces. It’s a step towards fairer premiums for everyone.

Emerging Coverage Options

Climate change is making insurers look for new ways to cover risks. They’re creating flexible policies that can handle changes in the environment. For example, they’re covering more risks like floods and wildfires.

They’re also looking into technology in home insurance like blockchain. This tech can make claims easier and help prevent fraud.

These changes show a future where tech and new coverage options are key. They’ll help homeowners get the protection they need against many risks.

Conclusion

Home insurance costs in the U.S. are rising. This is due to climate change, inflation, and higher repair costs. It’s important for homeowners to understand home insurance comparison summary and manage their costs well.

Reviewing your policy and comparing quotes from different providers can help. You can also lower your premiums by adjusting deductibles or bundling policies. Knowing about state laws, market trends, and insurance company finances helps you make better choices.

Homeowners need to stay ahead in the changing insurance world. They should use all resources to protect their homes effectively and affordably.