Bonds are a key part of investing for stable returns. But what are bond investments, and how do they help your portfolio? Learn about this fixed-income asset class and how it can meet your financial goals.

Bonds are known as fixed-income securities. They are debt instruments where investors lend money to governments, municipalities, or corporations. In return, they get a set interest rate and the return of their principal at a specific date. This makes bonds different from other investments, offering stability, income, and diversification.

Whether you’re new to investing or have experience, understanding bond investments is important. The bond market offers a wide range of options, from government-backed securities to corporate debt. This guide will help you learn about bonds, their role in portfolios, and strategies for investing in them.

Table of Contents

Understanding the Fundamentals of Bonds

Bonds are a type of fixed-income security. They represent a loan to the issuer, like a government or corporation. When you invest in bonds, you lend money to the issuer. You get a coupon rate and the face value at the maturity date.

This makes bonds key for many investors. They offer a steady income and help keep your capital safe.

Key Bond Terminology for Beginners

Before we dive into bonds in portfolios, let’s cover some key terms:

- Yield-to-Maturity (YTM): The total return expected from a bond if held until maturity.

- Duration: Shows how much a bond’s price changes with interest rate changes.

The Role of Bonds in Investment Portfolios

Bonds are vital in investment portfolios. They offer:

- Income Generation: Bonds give regular interest or the coupon rate. This income is steady for investors.

- Diversification: Bonds can spread out the risk in a portfolio. This can lower overall risk and volatility.

- Capital Preservation: Bonds, especially high-quality government ones, are safer than stocks. They’re great for keeping your capital safe.

Adding bonds to your strategy can help you reach your financial goals while managing risk. Knowing about bonds is the first step to a diversified portfolio.

How Bond Investments Generate Returns

Bond investments make money in two main ways: interest payments and capital appreciation. The bond’s yield is affected by its coupon rate, market price, and when it matures.

Buying a bond is like lending money to the issuer. They pay you regular interest payments, or coupons. These are usually paid out quarterly, twice a year, or yearly, giving you a steady income.

Bonds can also grow in value, known as capital appreciation. If you sell a bond for more than you paid, you make a profit. Prices change based on interest rates, the bond’s coupon rate, its time to mature, and the issuer’s credit.

For instance, buying a bond with a bond yield of 4% and holding it until it matures means you get all the interest. But, selling it before maturity for more can also give you a capital gain, boosting your returns.

The type of bond you choose, like government, corporate, or municipal bonds, affects interest payments and capital appreciation. Each bond has its own risk and returns, helping investors match their goals and risk levels.

Knowing how bond investments work can help investors make smart choices. They can build a portfolio that meets their financial needs, whether it’s for income, preserving capital, or both.

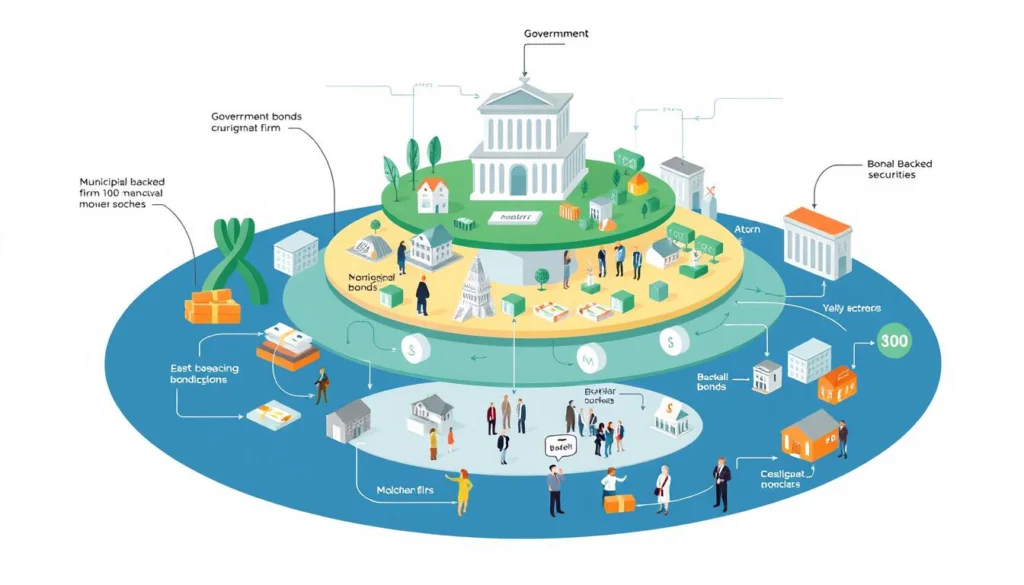

Types of Bond Investments

There are many bond investment types to explore. From government securities to corporate debt and municipal bonds, each has its own risk and return. Knowing about these options helps you diversify your portfolio and make smart choices.

Government and Treasury Bonds

Government bonds, like U.S. Treasury bills and bonds, are very safe. They are backed by the U.S. government, making them low-risk. U.S. Savings Bonds, like I-bonds and Series EE, are great for beginners with a low $25 investment.

Corporate Bonds

Corporate bonds help companies grow by raising capital. They are divided into investment-grade and non-investment-grade, or junk bonds. While non-investment-grade bonds might offer higher returns, they carry a higher risk of default.

Municipal Bonds

Municipal bonds fund public projects like schools and roads. They require a $5,000 minimum investment but offer tax benefits. This makes them a good choice for those looking for tax-efficient returns.

Agency Bonds

Agency bonds come from government-sponsored enterprises like Ginnie Mae and Fannie Mae. They are considered low-risk due to their strong credit ratings and government backing.

Exploring bond investments can help you meet your financial goals. By understanding treasury securities, corporate debt, muni bonds, and agency bonds, you can make informed choices. This can help you achieve your desired returns.

Bond Pricing and Interest Rate Relationships

Understanding the bond market is key, especially the bond price and interest rate link. When interest rates go up, bond prices drop. This is true the other way around, too. Knowing this is vital for bond valuation and grasping the bond market.

The yield curve is a tool for looking at the bond market and what the future might hold. It shows interest rates for bonds of different lengths. By studying the yield curve, investors can make smart choices for their bond portfolios.

Bond duration shows how much a bond moves with interest rate changes. Bonds with longer durations are more affected by rate change.s. This means longer-term bonds see bigger price swings than shorter-term ones.

Investors need to think about how rate changes affect their bonds. In times when rates are rising, shorter-term bonds or those with floating rates might be better. They don’t drop in price as much. But when rates are falling, longer-term bonds could be a good choice for making money.

By getting the bond price and interest rate relationship, and understanding the yield curve and bond duration, investors can make better choices. They can also handle the interest rate risk in their bond portfolios more effectively.

Bond Ratings and Credit Quality

Understanding bond ratings is key when investing in bonds. Agencies like Fidelity, Moody’s, and Standard & Poor’s rate bond issuers. These ratings help you figure out the risk and potential returns of your investments.

Investment Grade vs. High-Yield Bonds

Bonds fall into two groups: investment grade and high-yield (or “junk”) bonds. Investment-grade bonds are safer and offer stable returns. High-yield bonds are riskier but may pay more to make up for it.

Major Rating Agencies and Their Scales

Standard & Poor’s, Moody’s, and Fitch Ratings each have their own scales. Standard & Poor’s rates from AAA (top quality) to D (default). Moody’s uses Aaa, Aa, A, Baa, Ba, B, Caa, Ca, and C. Fitch Ratings have a similar scale.

Impact of Credit Ratings on Bond Values

Credit ratings greatly affect bond prices and yields. Bonds with higher credit ratings (investment grade) usually have lower yields. They are seen as less risky. On the other hand, lower-rated bonds (junk bonds) have higher yields to balance out their higher credit risk and default risk. This is something investors should think about when planning their portfolios.

The Bond Market Structure and Trading

The bond market has two main parts: the primary and secondary markets. In the primary market, new bonds are first sold to investors. This is where companies and governments raise money by selling their debt.

The secondary market deals with trading existing bonds. Here, investors buy and sell bonds based on market conditions and their goals. Trading happens through various ways, like over-the-counter (OTC) deals or online platforms.

The bond liquidity in the secondary market changes a lot. Government and high-quality corporate bonds usually have more liquidity. This is because they are seen as safer investments.

New technology has greatly helped the bond market. Electronic trading platforms have made finding prices easier, increased transparency, and cut costs. Bond exchange-traded funds (ETFs) have also made trading more liquid and diverse.

Investors can now use different strategies to trade bonds. They can choose from passive investing to more active trading. The bond market offers many chances to diversify and earn stable returns.

Bond Investment Strategies for Portfolio Growth

Managing your bond portfolio can be done in several ways to reach your investment goals. You can use laddering, buy-and-hold, or active trading. Each method has its own risk and returns to fit your needs. Let’s look at the main bond investment strategies for growing your portfolio.

Laddering Techniques

Laddering is a popular strategy. It involves buying bonds with different maturity dates. This helps manage interest rate risk by reinvesting the principal at new rates. It also diversifies your portfolio, providing steady income and flexibility in changing interest rates.

Buy and Hold Approaches

The buy-and-hold strategy is great for those who prefer a passive approach. It focuses on collecting interest and holding bonds until they mature. This method offers stability and predictability, avoiding the ups and downs of active trading.

Active Trading Strategies

Active trading involves buying and selling bonds based on market conditions. Managers use credit analysis, macroeconomic analysis, sector rotation, and duration management to find good deals. This approach requires more effort but can lead to higher returns for those willing to take on more risk.

The right bond investment strategy depends on your financial goals, risk tolerance, and time horizon. Understanding these strategies helps tailor your bond portfolio management for better diversification and fixed-income strategies.

Risk Factors in Bond Investing

When you invest in bonds, it’s important to know about the main risks. These include interest rate risk, credit risk, and inflation risk.

Interest rate risk happens when bond prices change with market interest rates. If rates go up, bond prices often drop. This can lower your investment’s value. But, if rates fall, bond prices might go up, giving you a chance to make money.

Credit risk is about the chance the bond issuer won’t pay back their debt. This risk is higher for corporate bonds, high-yield bonds, and some municipal bonds. They are more likely to default on their payments.

Inflation risk is when the value of your bond’s interest payments goes down over time. As inflation increases, the real value of your bond’s income may decrease. This can lower your investment’s return.

Other risks include liquidity risk, call risk for callable bonds, and reinvestment risk when interest rates drop. A diversified portfolio and understanding these risks can help you manage bond investments better.

Today, the usual 60/40 stock-bond mix is harder to maintain because stocks and bonds often move together. The Federal Reserve’s rate changes can also affect bond yields. This might impact how well your bonds perform.

To reduce these risks, you need a solid investment plan. It should match your risk level, financial goals, and the big picture of the economy. Knowing about bond investing risks can help you make better choices. This might improve your portfolio’s long-term success.

Benefits of Including Bonds in Your Investment Mix

Adding bonds to your investment portfolio can bring many benefits. From steady returns to diversification and keeping your capital safe, bonds are key. They help manage risk and ensure a steady income.

Income Generation

Bonds give you regular interest payments. This is great for those close to retirement or looking for steady income.

Portfolio Diversification

Adding bonds to your mix can make your portfolio less volatile. Bonds often move differently than stocks. This helps balance out the risks.

Capital Preservation

High-quality bonds, like government or top corporate bonds, act as a safety net. They are safer than stocks and help keep your money safe, especially when markets are shaky.

For both new and experienced investors, bonds add stability and diversification. By using bonds, you can improve your investment strategy and reach your long-term goals.

Advanced Bond Features and Variations

The bond market has more than just traditional fixed-income securities. It offers advanced features and variations for different investment needs. For example, convertible bonds let you turn your debt into the company’s stock, offering a chance for equity gains. Callable bonds, however, let the issuer pay back the bond early, which can be risky for investors.

Zero-coupon bonds are another interesting option. They are sold at a lower price and don’t pay interest. Instead, you get the full face value at maturity. These bonds are great for long-term savings or retirement planning. They can help improve your portfolio’s risk and return, diversify your income, or meet specific financial goals.

Whether you want steady income, potential growth, or both, the bond market has what you need. By understanding these bond variations, you can make better choices. This helps you tailor your fixed-income investments to fit your goals.