Are you sure your assets will go to the right people if you can’t manage them anymore or if you pass away? If not, it’s time to think about a living trust. This tool lets you control your wealth, making sure it goes to your loved ones smoothly and avoiding probate’s hassle.

Table of Contents

Understanding the Fundamentals of Living Trusts

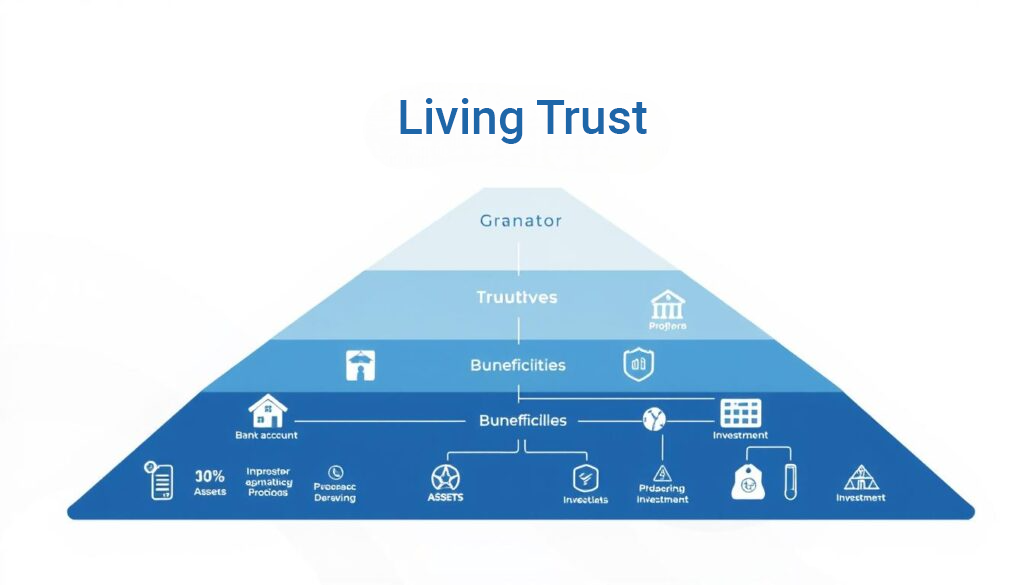

Living trusts are powerful legal tools. They help manage and distribute your assets during your lifetime and after. A living trust outlines how your assets should be handled and who will manage them – the trustees.

The key parts of a living trust are the grantor, the trustee, and the beneficiaries. The grantor is the person who creates the trust. The trustee manages the trust. The beneficiaries are the people who get the trust assets.

Definition and Basic Structure

A living trust is created while you’re alive. It’s a legal setup that manages assets for certain people. Unlike a will, it lets you control your assets while you’re alive.

Key Components of a Living Trust

- Grantor: The person who creates and funds the living trust.

- Trustee: The person or group that manages the trust assets.

- Beneficiaries: The people or groups who get the trust assets.

Role of Trustees and Beneficiaries

Trustees are key in managing the trust assets. They make sure the assets are given out as the grantor wishes. They must act in the best interest of the beneficiaries.

Beneficiaries are the ones who get the trust assets. Their rights and interests are protected by the trust document.

Living Trusts Explained: A Comprehensive Overview

Living trusts are a key part of estate planning. They let you control who gets your assets and can save on taxes. Unlike wills, they avoid probate, keeping things private and quick.

They also help manage your assets if you can’t make decisions. You can change or cancel them as needed, depending on the type.

There are three main roles in a living trust. The person creating the trust is the settlor. The trustee manages the assets. The beneficiaries get the assets after the settlor’s death.

Usually, the settlor is also the trustee. But, a successor trustee takes over if needed.

The trustee is in charge of managing the trust’s assets. They can be an individual or a bank. Living trusts only work when assets are moved into them.

Beneficiaries can get benefits while the settlor is alive or after they pass away.

Living trusts can save a lot of money on taxes. They can cut down federal estate taxes, which can be as high as 55%. The tax exemption has changed over time, from $1 million to $5 million.

Living trusts also offer other benefits. They avoid probate and help manage property. They provide privacy and protect assets for beneficiaries.

But, they don’t protect the settlor from creditors. They only protect the assets of the beneficiaries.

Most living trusts can be changed or cancelled by the settlor. The successor trustee takes over after the settlor’s death or if they become unable to manage. It’s important to have a “Pourover Will” to cover any assets not in the trust.

Types of Living Trusts: Revocable vs. Irrevocable

You have two main choices for living trusts: revocable and irrevocable. Each has its own benefits and features. It’s important to think about your financial goals and estate planning needs when choosing.

Revocable Trust Features and Benefits

A revocable trust lets you control your assets while you’re alive. You can change or cancel it whenever you want. This flexibility is great if your financial situation changes.

But, assets in a revocable trust are still part of your estate. This means you might not save on estate taxes.

Irrevocable Trust Characteristics

An irrevocable trust moves your assets out of your control. This can help with estate taxes and protect your assets. But you can’t change or end the trust easily. You need everyone’s agreement or court approval.

Choosing Between Trust Types

- If you want to make changes easily, a revocable trust might be best.

- For strong asset protection and tax savings, an irrevocable trust is better.

- The right choice depends on your financial situation, goals, and what you prefer.

Understanding the pros and cons of each trust type is key. Talking to an estate planning lawyer can help you make the right choice for your future.

The Power of Probate Avoidance

Living trusts help avoid the probate process, saving time and money. They allow for quick distribution of assets to beneficiaries. This also means lower legal fees and privacy in estate details.

They are especially useful for those with complex estates or assets in different states. This simplifies transferring assets and reduces the burden on inheritors.

Living trusts can save a lot of money. Probate fees can be 4% to 8% of the estate’s value. In California, probate can take 16 to 24 months due to court delays.

Setting up a living trust may cost money at first. But, it saves a lot in the long run by avoiding probate and legal fees. Revocable living trusts let the grantor change or cancel the trust anytime. This keeps control over asset distribution.

It’s important to fund a living trust correctly. This means moving assets into the trust’s name. This way, assets are distributed as wished, skipping the long probate process.

Living trusts also keep asset distribution private. Unlike probate, which is public. They can also reduce taxes, keeping more for inheritors.

In summary, living trusts are powerful for avoiding probate. They make estate planning easier, offer privacy, and control. They ensure assets are distributed efficiently and cost-effectively to beneficiaries.

Asset Protection and Management Strategies

Living trusts are a strong tool for asset protection and managing wealth. They use irrevocable trusts to keep your assets safe from creditors. This way, your hard-earned wealth stays protected.

They also make managing your assets easy, even if you can’t do it yourself. This is helpful if you ever lose the ability to manage your finances.

Living trusts also help lower estate taxes. This means more of your estate goes to your loved ones. They use tax exemptions and smart planning to reduce taxes.

Protecting Your Wealth

Irrevocable trusts take away your ownership rights. This makes your assets safe from creditors and legal judgments. It’s great for people with a lot of money, professionals, or those in risky jobs.

Managing Assets During Incapacity

Living trusts make managing your assets easy if you can’t do it yourself. A trustee can take over and keep your finances in order. This protects your wealth and interests when you need it most.

Estate Tax Considerations

Setting up a trust the right way can lower your estate’s taxes. This means more money for your family. Using tax-efficient strategies and exemptions can greatly reduce estate taxes.

Living trusts are a complete solution for asset protection, wealth management, and estate tax planning. They ensure your financial legacy is safe and your wishes are followed.

Privacy Benefits of Living Trusts

Managing your estate means keeping your privacy. Living trusts offer better privacy protection and confidentiality than wills. Trust documents and how assets are shared stay private, unlike wills which become public during probate.

This privacy is key for those with a lot of wealth or facing legal challenges. It keeps your estate plan and beneficiaries’ details private. This is great for families wanting to keep their financial matters private.

Living trusts also prevent family conflicts. Keeping asset distributions private reduces the chance of disputes. These disputes can be costly and time-wasting.

Living trusts also give you more control over your assets. You can change or update the trust as needed. This ensures your estate plan always reflects your current wishes.

Thinking about the privacy protection and confidentiality of living trusts is wise. It helps your estate plan meet your wishes while protecting your family’s financial privacy and security.

Setting Up Your Living Trust: Step-by-Step Process

Creating a living trust is key to good estate planning. You need to make a trust document, pick trustees and beneficiaries, and move assets into the trust. First, gather your documents like the trust agreement, asset lists, and transfer deeds.

Asset Transfer Process

Transferring assets is a big part of setting up a living trust. You’ll need to change property titles, update account holders, and make sure beneficiary names are correct. Working with banks and lawyers is crucial for a smooth asset transfer.

Legal Considerations

Legal stuff matters when you set up a living trust. You must know state laws, understand taxes, and make sure the trust fits your estate plan. Getting help from legal experts is important to make sure your trust works right.

Setting up a living trust might seem hard, but with the right help, it’s easier. By thinking about all the legal and financial details, you can make a trust that protects your assets. This is true both when you’re alive and after you pass away.

The Role of Professional Assistance

Getting help from estate planning attorneys and financial advisors is crucial for a living trust. They know how to make your trust fit your estate planning goals. They also make sure it follows all legal rules.

Estate planning attorneys give advice on the trust’s details, taxes, and how to protect your assets. They help you understand the legal side, making sure your trust meets your specific needs. Financial advisors help manage your trust’s assets, improve investments, and find ways to lower your taxes.

Professional advice is key for big assets, complex estates, or tax worries. They guide you through trust administration. This ensures your trust works as planned, avoiding probate and keeping things private.

By teaming up with estate planning attorneys and financial advisors, you can trust your living trust is set up right. It will serve your long-term goals and your beneficiaries’ needs.

Creating a successful living trust needs a team effort. With professional advisors, you get a solid estate plan. It offers the protection, control, and peace of mind you want.

Living Trust Maintenance and Updates

Keeping a living trust up to date is key. It must reflect your current life and finances. Regular checks and updates are vital to keep your estate plan working for you.

Regular Review Schedule

Experts say to check your living trust every 3 to 5 years. Or after big life changes like getting married, divorced, having a child, or a financial shift. This helps ensure your trust matches your current wishes and goals.

Making Amendments

Need to change your trust? You can with formal amendments or a new trust document. This lets you adjust your trust as your life changes. You can update beneficiaries, change how assets are shared, or handle family or financial changes.

Keeping your living trust current and making changes as needed is crucial. It keeps your estate plan effective and in line with your wishes. Being proactive ensures your plan works for you and your loved ones.

Cost Considerations and Long-term Savings

Setting up a living trust might cost more than making a simple will at first. But, the long-term savings and benefits often make up for the initial costs. The more complex and valuable your estate is, the more a living trust saves you in the long run.

Creating a living trust can cost between $1,000 and $2,500. Basic will start at $150 and can go up to $1,000. The price varies based on your assets, legal fees, and the help you need from professionals. Also, living trusts have ongoing fees of about 0.5% to 1% of the trust’s value.

The initial trust costs might seem high, but the savings in estate planning can be huge. Living trusts avoid the expensive and slow probate process. They also keep your estate private and can lower estate taxes, adding to the long-term financial gains.

Think about both the upfront costs and the future savings when considering a living trust. A well-made living trust can save you money in the long run. It ensures your assets are safe and your wishes are followed.

Choosing to create a living trust should be a careful decision. It depends on your financial situation, estate planning goals, and long-term savings. Talking to a qualified estate planning expert can help you make the right choice for your needs and future benefits.

Common Misconceptions About Living Trusts

There are many myths about living trusts in estate planning. People often think they are only for the rich, eliminate all estate taxes, or are too hard to manage. But, the truth is far from these myths.

Many believe living trusts are only for the wealthy. But, they can help anyone, from those with small to large assets. Living trusts help avoid probate, protect assets, and distribute them efficiently. They are useful for everyone, not just the rich.

Another myth is that living trusts get rid of all estate taxes. While they can help with taxes, they don’t eliminate all of them. It’s important to know the tax rules and work with experts to get the most tax benefits.

- Living trusts are seen as complex, but they can be simple with the right setup and advice.

- Some think living trusts are the only way to avoid probate. But, wills, powers of attorney, and health care directives can also help.

Knowing these myths helps people make better choices about living trusts in their estate plans. It’s key to work with experienced professionals. They can help make sure your trust fits your financial and personal goals.

Integration with Overall Estate Planning

Comprehensive estate planning is key, and living trusts are a big part of it. To manage your estate well, it’s vital to link your living trust with other important documents. Also, make sure it works with various estate planning tools.

Complementary Documents

Along with your living trust, think about adding these essential estate documents:

- Pour-Over Will: This ensures any assets not in your living trust go to it when you pass away, skipping probate.

- Durable Power of Attorney: This lets someone you trust handle your money if you can’t.

- Healthcare Directives: These tell your loved ones what medical care and end-of-life choices you prefer.

Coordination with Other Estate Tools

Your living trust should also work with other estate planning tools, such as:

- Life Insurance Policies: Make sure your life insurance beneficiaries match your living trust’s goals.

- Retirement Accounts: Align the beneficiaries of your retirement accounts with your living trust.

- Gifting Strategies: Include any planned gifts or charitable donations in your estate plan.

By linking your living trust with these documents and tools, you create a complete plan. It covers all parts of your estate and meets your financial and personal goals.

Tax Implications and Benefits

Living trusts can offer big tax benefits if set up right. It’s key to know how different trusts work with taxes to get the most out of them.

Revocable living trusts don’t give tax benefits right away. Moving assets into a revocable trust doesn’t change your taxes. You still report all trust income on your own tax return because you control it.

Irrevocable trusts, however, might save on estate taxes. For example, generation-skipping trusts can cut taxes on gifts to your grandkids. But, moving assets to an irrevocable trust might lead to gift tax issues, based on the assets’ value.

Trust income tax treatment depends on the trust type. Grantor trusts are taxed like you own them, so you report their income on your tax return. Non-grantor trusts might be taxed at the trust level or passed to beneficiaries based on the trust’s rules.

Trusts have lower tax brackets than individuals. The highest federal tax rate of 35% kicks in at a much lower income level of $11,650 in 2012. Planning well is crucial to use tax planning benefits and reduce estate taxes from living trusts.

Conclusion

Living trusts are key in estate planning. They help avoid probate, keep your estate private, and manage assets well. They are a great way to protect your financial future and make sure your assets go to the right people.

Living trusts save your family from the long and expensive probate process. They keep your financial details private, protecting your family’s information. They also help protect your assets and plan for when you might not be able to make decisions.

If you want to make your estate plan simpler, reduce taxes, or take care of your loved ones, consider a living trust. An experienced estate planning lawyer can help you create a trust that fits your needs. With their help, you can make sure your estate plan reflects your values and benefits your family for years to come.