Do you feel like your money is slipping away? Want to control your financial future and make every dollar count? Zero-based budgeting might be what you need.

Zero-based budgeting (ZBB) changes how you manage money. It’s different from traditional budgeting, which just adds a little more each time. With ZBB, you justify every expense, starting fresh each month. This helps you find hidden spending and save money, reaching your financial goals.

Table of Contents

We’ll cover the basics of zero-based budgeting next. We’ll show you how to make your first budget and give you the tools and strategies to master it. Are you ready to take charge of your finances and make every dollar work for you? Let’s begin!

Understanding Zero-Based Budgeting Fundamentals

Zero-based budgeting (ZBB) changes how we budget. It’s different from incremental budgeting, where you adjust last year’s budget. With ZBB, you start from scratch each time. This means looking closely at every cost control and expense management item to make sure they fit your budget allocation goals.

Core Principles of Zero-Based Budgeting

There are three main ideas in ZBB:

- Every dollar has a purpose – You must explain why you’re spending each dollar, not just carry over old expenses.

- The zero-sum approach – Your income minus expenses should equal zero for a balanced budget.

- Strategic alignment – ZBB helps you focus on spending that supports your company’s goals and priorities.

Following these principles helps you manage costs better and make smarter budget choices. This leads to clearer financial views, tighter cost control, and more informed decisions.

Zero-Based Budgeting Explained: A Step-by-Step Guide

Using a zero-based budget is a smart way to manage your money. It’s different from old budgeting methods because you justify every expense. This means every dollar you earn has a purpose, cutting down on waste.

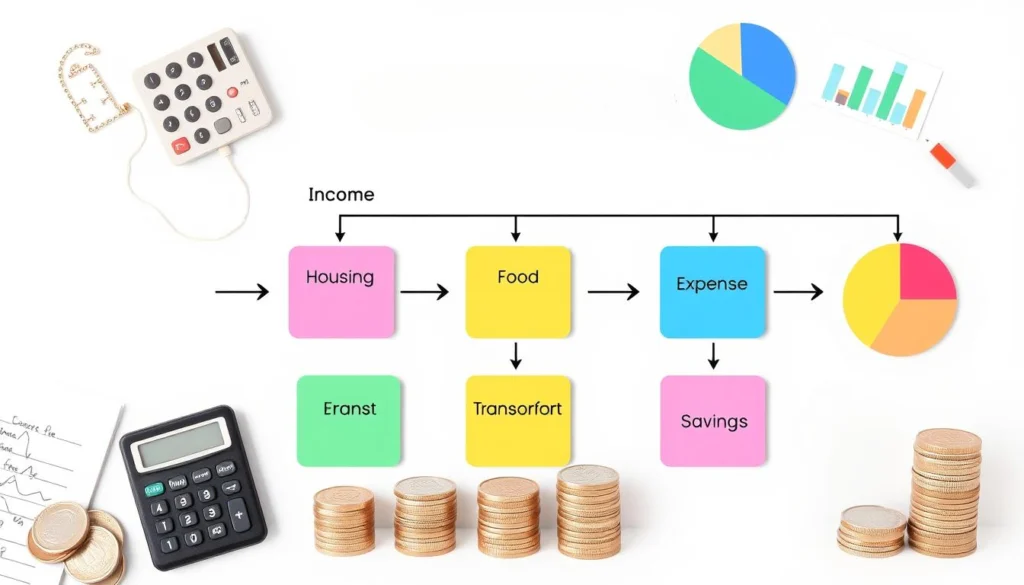

To start a zero-based budget, first list your monthly income. This includes your regular pay and any extra money you make. Then, sort your expenses into categories:

- Giving (charitable donations or tithing)

- Savings (for emergencies, retirement, etc.)

- The Four Walls (food, utilities, shelter, and transport)

- Other Essentials (insurance, debt, childcare, etc.)

- Extras (fun, dining out, hobbies, etc.)

- Month-Specific Expenses (for holidays, celebrations, etc.)

Once you’ve assigned your income to these categories, subtract your expenses from your income. This should leave you with zero. If not, adjust your spending to balance your budget.

Keep track of your spending throughout the month. Before the next month starts, make a new zero-based budget. Consider any new expenses or changes you might have.

Adopting a zero-based budget helps you spend smarter and control your finances better. It promotes cost-effectiveness and aligns your spending with your goals. This way, you can reach your financial dreams over time.

Historical Background and Evolution of Zero-Based Budgeting

Zero-based budgeting started in the late 1960s by Peter A. Pyhrr, a former Texas Instruments account manager. It was first for businesses but now helps with personal finances too. This shows how effective it is in different areas.

Origin at Texas Instruments

Pyhrr came up with zero-based budgeting at Texas Instruments in the 1970s. The idea is to use every dollar for something specific. This way, what you earn minus what you spend equals zero. It’s better than old methods that just use last month’s budget.

Modern Applications in Personal Finance

Zero-based budgeting became popular in business and then in personal finance. Many people and families use it to manage their cost-cutting measures and fiscal responsibility. It helps them find and cut unnecessary spending, improving their financial control and goal alignment.

Evolution from Business to Personal Use

The move from business to personal use shows zero-based budgeting’s flexibility. It might take a lot of time at first, but it gets easier. It’s great for those with stable incomes who want better financial control or to save and pay off debt.

Essential Components of a Zero-Based Budget

Creating a zero-based budget means planning every dollar you earn. You need to make sure every expense is needed and justified. Let’s look at the main parts of a good zero-based budget:

- Total Monthly Income – Start by figuring out how much you make each month. This includes wages, salaries, investments, and more.

- Fixed Expenses – These costs don’t change, like rent, mortgage, insurance, and debt payments.

- Variable Expenses – These costs change each month, like groceries, gas, utilities, and entertainment. You need to budget for these too.

- Savings Allocations – It’s important to save some money for emergencies and long-term goals.

- Discretionary Spending – If you have money left after covering all other costs, you can spend it on things you want, like dining out or hobbies.

The secret to a good zero-based budget is to use every dollar for something. This could be for essential costs, saving, or spending on things you enjoy. By planning each expense carefully, you can manage your money better. This helps you reach your financial goals.

Creating Your First Zero-Based Budget Plan

Starting a zero-based budget means knowing your finances well. First, calculate your total monthly income from jobs, investments, or other regular money. This is the base of your budget plan.

Then, group your expenses into clear categories like housing, utilities, food, and debt. Put a specific amount in each group. Make sure your total spending doesn’t go over your income. Also, save money for savings and other financial goals.

- Calculate your total monthly income from all sources.

- Categorize your essential expenses into distinct groups, such as Housing (rent, mortgage, utilities)

- Food (groceries, dining out)

- Transportation (car payments, gas, insurance)

- Debt obligations (credit card payments, student loans)

- Allocate a specific amount for each expense category, ensuring your total outgoings do not exceed your monthly income.

- Set aside funds for savings and any other financial goals you may have.

After that, use any leftover money for discretionary spending. This includes fun stuff like entertainment and hobbies. The goal of a zero-based budget is to use every dollar wisely, ending with no money left over.

By following financial planning and budgeting strategies of zero-based budgeting, you can manage your money better. This helps you reach your financial goals over time.

Tracking Expenses in Zero-Based Budgeting

Effective expense management is key to a successful zero-based budget. You need to track all your money, both what you earn and what you spend. This way, you can see where your money goes and stick to your budget.

Digital tools and apps make tracking easier. They help you stay organized and on track with your budget. With these tools, you can record, categorize, and monitor your spending. This lets you make better choices about how to spend and save your money.

- Choose a consistent way to record your income and expenses, like a budgeting app or spreadsheet.

- Group your expenses into categories, like housing, transportation, and groceries. This helps you see where your money goes.

- Check your spending regularly. Compare it to your budget to find ways to save or adjust.

- Use features like tagging, automated categorization, and reports in budgeting apps to make tracking easier.

- Match your bank and credit card statements to your records to keep them accurate and up-to-date.

By tracking your expenses well and sticking to your zero-based budget, you learn a lot about your spending. This knowledge helps you make better financial choices. It also helps you reach your long-term financial goals.

Remember, the secret to successful zero-based budgeting is to watch your expenses closely. With regular tracking and strict budgeting, you can manage your money well. This leads to a secure and prosperous financial future.

Zero-Based vs. Traditional Budgeting Methods

Zero-based budgeting (ZBB) and traditional budgeting have different ways of handling money. Traditional budgeting builds on past spending, while ZBB starts from scratch each time. This makes ZBB more thorough but also more challenging.

Key Differences in Approach

With ZBB, every expense is reviewed each time a budget is made. This ensures only necessary costs are included. Traditional budgeting, on the other hand, uses a top-down method. It starts with what senior management thinks is needed, based on past spending.

Comparative Benefits Analysis

- Cost Efficiency: ZBB can cut costs and make spending more efficient. Traditional budgeting might keep old, inefficient ways of spending.

- Accountability and Accuracy: ZBB makes sure spending is based on real needs, not just small changes. Traditional budgeting might not be as accurate.

- Agility: ZBB helps organizations quickly adjust to new situations. Traditional budgeting can be slower to adapt.

But, ZBB has its downsides. It takes a lot of time to review and justify every expense. Clear communication with stakeholders is also required to avoid misunderstandings.

Choosing between zero-based and traditional budgeting depends on your needs. Understanding the differences and benefits can help you pick the best strategy for your financial planning.

Common Challenges and Solutions in Zero-Based Budgeting

Zero-based budgeting (ZBB) has many benefits, like better cost-cutting and spending optimization. However, there are also some common problems that companies need to solve.

One big challenge is how time-consuming ZBB can be. It takes a lot of work to justify every expense, especially for big companies. To fix this, experts suggest starting small. Begin with a few areas, and then add more as you go.

Another issue is guessing variable expenses, like utility costs. To solve this, use past data to make better guesses. Then, adjust the budget as the year goes on.

- ZBB might focus too much on saving money right now. This can make it hard to see the big picture. It’s important to balance short-term and long-term goals for financial health.

- Changing to ZBB can be hard because people might not want to justify every expense. Good communication, training, and change management can help.

By tackling these challenges and finding smart ways to solve them, companies can make the most of zero-based budgeting. This leads to better cost-cutting, spending optimization, and financial success in the long run.

Tools and Resources for Zero-Based Budgeting

Improving your budget allocation and expense management can change your financial game. Luckily, many digital tools and resources are out there to make it easier. They help you take charge of your money.

Digital Apps and Software

The EveryDollar app is a top pick for zero-based budgeting. It lets you track your income and expenses easily. Plus, you can adjust your budget in real-time. It’s great for beginners because it’s so user-friendly.

Spreadsheet Templates and Calculators

For a hands-on approach, there are free spreadsheet templates and online calculators. They help you plan your budget and track your spending. These tools ensure every dollar is used wisely. They give you a clear view of your finances, helping you make smart choices about spending and saving.

Using these tools can make zero-based budgeting easier. It improves your financial clarity and lets you make better budget allocation and expense management choices.

Maximizing Savings Through Zero-Based Budgeting

Zero-based budgeting is a strong tool for financial planning and cost control. It helps you save money by carefully planning every expense. You can save more by cutting down on unnecessary spending and focusing on your financial goals.

This method follows the “zero-sum” rule. Your income minus your expenses should equal zero by the end of the month. It teaches you to watch your spending and cut out things you don’t need, saving more for your goals.

Zero-based budgeting lets you keep a close eye on your money. It’s a hands-on way to manage your finances. This can change your financial life, helping you reach your financial planning targets and control your spending better.

Compared to other budgeting methods, zero-based budgeting is more flexible. You start fresh each month, allocating every dollar to a specific need. This ensures your money matches your current financial goals and priorities.

Adopting zero-based budgeting can be a major step towards financial success. It helps you save more and stay focused on your financial goals. This way, you’re on the path to achieving your long-term financial dreams.

Implementing Zero-Based Budgeting for Variable Income

Creating a budget can be tough when your income changes every month. This is common for freelancers or those with jobs that change with the seasons. But, the basics of zero-based budgeting can still help you manage your money well, even with ups and downs in income.

Strategies for Freelancers

Freelancers should start with a budget based on their lowest monthly income. This way, you can make sure you have enough for basic needs like rent, utilities, and food, even when money is tight. Use extra money from good months to save, pay off debt, or for fun.

Managing Seasonal Income Fluctuations

- Keep a bigger emergency fund to cover costs when money is scarce.

- Focus on must-haves and adjust what you can spend on fun as your income changes.

- Check and change your budget often to keep up with your financial life.

With smart budgeting strategies and wise resource allocation, you can stay financially stable and meet your goals, even with an income that’s not always steady.

Long-Term Financial Planning with Zero-Based Budgeting

It’s key to plan your finances well for long-term goals. Zero-based budgeting (ZBB) is a great way to help you reach financial stability and success.

ZBB focuses on spending based on what’s most important to you. By using every dollar wisely, you can save for big things, pay off debt, or plan for retirement.

- Adaptable to Life Changes: ZBB lets you change your budget as your life changes. This keeps your spending in line with your new priorities.

- Intentional Money Management: ZBB’s zero-sum method means you use every dollar carefully. This stops money from slipping away or being spent on impulse.

- Achieving Long-Term Goals: ZBB helps you focus on your long-term goals. It builds a secure future and helps you reach your dreams.

Using zero-based budgeting for financial planning gives you control over your money. It helps you make a plan for long-term success. By spending wisely, you can handle life’s changes and move closer to your fiscal responsibility goals.

Advanced Strategies for Zero-Based Budget Optimization

Now that you know the basics of zero-based budgeting, it’s time to dive into more advanced strategies. These methods help you make the most of your budget, cutting costs and optimizing spending. This ensures every dollar has a purpose.

One important strategy is to regularly review your spending. Use past data to improve your budget estimates and add specific financial goals. This keeps your budget flexible and helps you find new ways to save.

- Regularly review and update spending categories

- Leverage historical data to refine budget estimates

- Integrate financial goals into your budget line items

Another advanced technique is to have different budgets for various financial scenarios. You might have a budget for lean times, a more ambitious one for growth, and a contingency budget for surprises. This way, you’re ready for anything and can take advantage of opportunities.

Setting aside funds for big, irregular expenses is also key. Instead of being caught off guard, save a bit each month for these costs. This keeps your finances smooth and ensures you’re always ready.

Lastly, don’t forget to challenge your fixed costs. Look at things like subscriptions, memberships, and insurance to see where you can save. Often, just a little negotiation can lead to big savings.

By using these advanced strategies, you can make your zero-based budget work even better. You’ll save money, stay financially stable, and control your financial future.

Real Success Stories and Case Studies

Zero-based budgeting (ZBB) has changed many people’s financial lives. It lets them control their spending and see big changes. These personal finance transformations show big debt reductions, more savings, and better financial health.

Some ZBB users paid off big credit card debts in just a year. Others built a six-month emergency fund. These debt elimination examples show how zero-based budgeting works in real life.

Personal Finance Transformations

- Paid off substantial credit card debt within a year

- Built a six-month emergency fund

- Achieved greater financial stability and control

Debt Elimination Examples

- Eliminated $15,000 in credit card debt in 12 months

- Became debt-free and started contributing to retirement savings

- Gained the confidence to pursue financial goals, such as buying a home

These stories show how zero-based budgeting can change lives. It helps people reach their financial planning and budgeting strategies goals.

Conclusion

Zero-based budgeting is a strong tool for managing money. It helps people control their spending and reach financial stability. By planning every dollar, it makes you aware of costs and helps you use resources wisely.

Starting a zero-based budget takes more time than usual. But, it can lead to big savings, paying off debt, and better financial health. Learning about zero-based budgeting can help you manage your money better.

Adopting zero-based budgeting can change your finances for the better. It helps you spend smarter, save more, and build a strong financial future. It’s great for paying off debt, building an emergency fund, or saving for a big goal.